Does ‘Sigonfile’ appear on your bank statement? That can be confusing and unsettling. what is “Sigonfile transaction” on your bank statement? is many account holders’ main query. These strange entries may cause you to worry about the security of your financial accounts and possible illegal behavior.

It might be a warning sign for questionable activities or a signal of particular kinds of transactions in certain situations. It can help you protect your money more effectively. This exploration is more than just simply meaning a term; it’s about safeguarding your financial stability and mental peace.

Join us as we explore Sigonfile in greater detail, giving you the skills to recognize and deal with these entries on your bank statement.

What is a Sigonfile on a Bank Statement?

Sigonfile is not a standard banking term and does not have a universally accepted definition in the context of bank statements. Its appearance on bank statements has raised concerns among account holders. It may appear as a descriptor for certain transactions, but clear information often leads to clarity and concern.

Origin of Sigonfile Charges

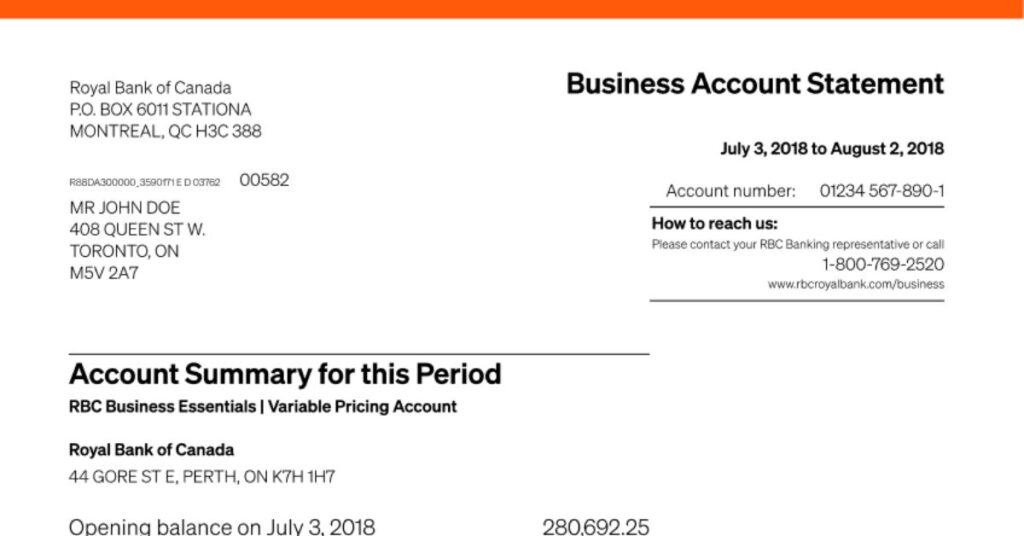

The Sigonfile charge originates from RealPage, a prominent company in property management software, particularly through its payment subsidiary, RealPage Payments.

This charge is associated with the processing of online rent payments, where RealPage facilitates the transfer of tenant payments to property managers.

It provides a streamlined and efficient method for handling rent transactions electronically and simplifying the rental payment process.

Sigonfile and Bank Statement Security

The presence of Sigonfile on bank statements can raise significant security concerns, as it’s often associated with unknown or unauthorized transactions. This term, which appears vague or unfamiliar, could indicate fraudulent activity on an account.

Immediate verification of the transaction’s legitimacy and origins. In safeguarding against potential fraud and maintaining the security of one’s financial information.

How to Identify Sigonfile Charges?

Regularly review your information for any unfamiliar or unexpected entries to identify Sigonfile charges on your bank statement. Look for the term “Sigonfile” next to specific transaction amounts. These reviews frequently to promptly detect any unusual activity. If you encounter a Sigonfile charge, investigate further to verify the transaction’s legitimacy, as it could indicate unauthorized activity.

How Sigonfile Charges Are Calculated?

A couple of main factors influence the Sigonfile charges:

- the percentage of the rent amount and

- a fixed fee component

These variables can fluctuate based on the specific policies of the property management company and the payment method chosen by the tenant.

This structure allows for flexibility in billing but also necessitates that tenants understand the breakdown of these charges to anticipate their rent payment costs accurately.

Legitimacy Concerns of Sigonfile Charges

RealPage is recognized in the property management software sector for its reliability. These charges are understandable, but their origin from a reputable company like RealPage offers assurance. This credibility is significant for both tenants and property managers, affirming the authenticity of transactions facilitated by RealPage’s systems.

Action Steps if You Encounter Sigonfile

If you encounter Sigonfile charges on your bank statement, take these immediate actions:

- Inform your bank about the unrecognized Sigonfile charge. They can provide information and initiate an investigation if needed.

- Check your recent transactions to see if any other unauthorized activities have occurred.

- Update your online banking passwords and PINs to secure your account.

- Keep a close eye on your account for any further unusual activity.

- Consider placing a fraud alert on your credit report if you suspect identity theft or fraud.

Preventing Unauthorized Sigonfile Charges

To prevent unauthorized Sigonfile charges:

- Regularly check your bank statements for any unrecognized transactions.

- Avoid banking over unsecured or public Wi-Fi networks.

- Set up alerts for real-time transactions to be informed of any activity.

- Ensure your online banking password is strong and unique.

- Be cautious of emails or messages asking for sensitive banking information.

- Keep your banking app and device software up to date for enhanced security.

Conclusion

In conclusion, understanding Sigonfile charges on bank statements is crucial for maintaining financial security. Being vigilant, regularly reviewing bank statements, and taking prompt action if unfamiliar charges appear are critical to safeguard against potential fraud.

It’s important to stay informed and proactive in managing your banking transactions, as this protects your finances and provides peace of mind. Always communicate with your bank regarding any concerns to ensure the safety and integrity of your financial accounts.