Commodities have always played a vital role in global trade, serving as the backbone of economies and a cornerstone for investors seeking to diversify their portfolios. From energy sources like crude oil and natural gas to agricultural products such as wheat and coffee, commodity markets provide opportunities for both hedging and speculation. However, with multiple trading instruments available, many investors wonder which path suits them best: Contracts for Difference (CFDs) or traditional futures contracts.

At first glance, commodities CFDs and futures may appear similar since both allow traders to speculate on the price movements of underlying assets without necessarily owning them. Yet the way these instruments are structured, traded, and managed makes them fundamentally different. Understanding these differences can help traders choose the right instrument for their financial goals, risk appetite, and trading style.

What Are Commodities CFDs?

Contracts for Difference, or CFDs, are derivative instruments that allow traders to speculate on the price movement of commodities without buying or selling the actual asset. When trading a commodity CFD, the trader agrees with a broker to exchange the difference in the price of the commodity between the opening and closing of the trade.

One of the most appealing aspects of CFDs is flexibility. Traders can go long if they believe prices will rise or short if they expect them to fall, often with a relatively low capital outlay thanks to leverage. Unlike futures contracts, CFDs do not have fixed expiry dates, meaning positions can be held for as long as the trader maintains sufficient margin.

For retail traders, especially, CFDs offer accessibility. They can start with smaller position sizes, avoid dealing with complex contract specifications, and often gain exposure to a wide range of commodities on a single trading platform.

What Are Commodity Futures?

Futures contracts, by contrast, are standardised agreements traded on regulated exchanges that obligate the buyer to purchase, and the seller to deliver, a specific quantity of a commodity at a predetermined price and date in the future. They are one of the oldest forms of derivative trading and remain crucial for hedging against price volatility in global commodity markets.

For instance, an airline company may use crude oil futures to lock in fuel costs, reducing exposure to unexpected price spikes. Similarly, farmers may hedge their harvest by selling agricultural futures to secure predictable revenue, even before the crop is harvested.

The liffe exchange, historically a prominent platform for futures trading in Europe, illustrates how regulated exchanges provide transparency, standardised contracts, and centralised clearing to reduce counterparty risk. Unlike CFDs, which are over-the-counter products offered by brokers, futures contracts always operate within these regulated environments, offering additional layers of security and oversight.

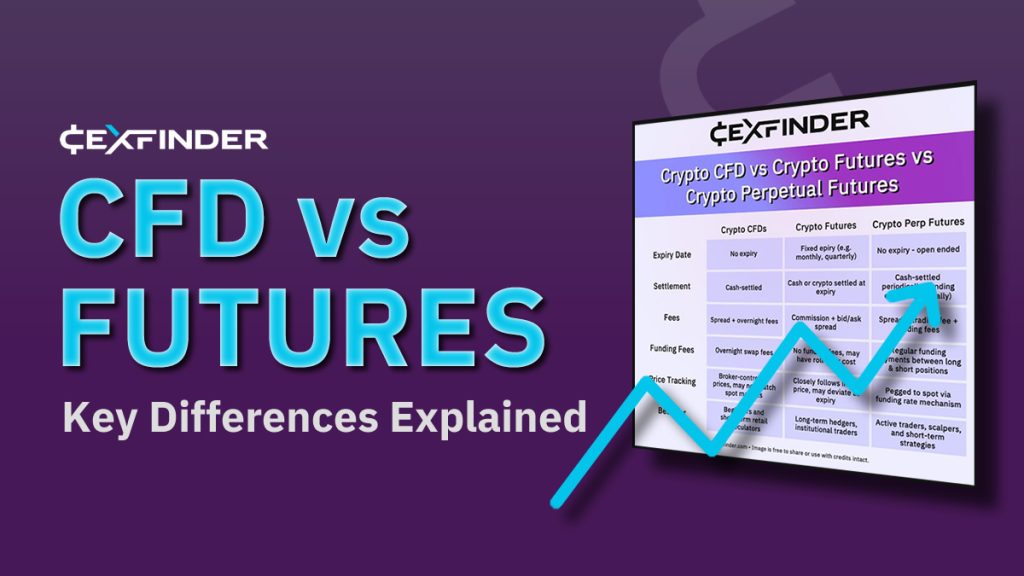

Key Differences Between CFDs and Futures

CFDs are generally more accessible to retail traders due to lower capital requirements and the absence of standardised lot sizes. Futures, on the other hand, often involve large contract sizes, which can make them challenging for smaller traders. Margin requirements in futures are also typically higher, demanding a larger initial outlay.

CFDs do not come with an expiry date, offering flexibility to hold a position for as long as desired. Futures, however, have fixed expiry dates, and traders must either roll over their contracts to extend their position or accept settlement (cash or physical delivery, depending on the contract).

CFDs are traded through brokers in over-the-counter markets, giving traders access to a wide range of global commodities from a single account. Futures are only available on specific exchanges, such as the CME or ICE, where contracts are listed and regulated.

Which Should You Choose?

The decision between trading commodities, CFDs and futures comes down to your objectives and resources as a trader.

If you are a retail trader seeking flexibility, lower capital requirements, and straightforward access to global commodity markets, CFDs may align better with your strategy. Their lack of expiry dates, ability to trade in small sizes, and wide availability on broker platforms make them a convenient choice for those focused on short- to medium-term speculation.

On the other hand, if you are a professional trader, institutional investor, or business seeking to hedge significant exposure to commodity prices, futures contracts provide the security of a regulated exchange, standardised terms, and transparency. They are particularly well-suited for large-scale participants who value certainty and risk management over flexibility.

Conclusion

Both commodities, CFDs and futures, offer valuable ways to engage with global commodity markets, but they cater to different needs and trading styles. CFDs emphasise accessibility, flexibility, and speculative opportunities for retail traders, while futures maintain their role as powerful instruments for hedging and institutional-level participation.

By understanding the differences in structure, costs, accessibility, and purpose, traders can make informed decisions about which instrument best aligns with their goals. Whether you choose CFDs for their simplicity or futures for their regulatory oversight and professional applications, both paths offer the potential to benefit from the dynamic and ever-changing world of commodities trading.